Raises and salary increases are something that catches every employee’s eye. Federal employees in particular have a lot of benefits available to them throughout their service. One of those benefits is Locality Pay, which provides an increase to your salary based on where you live and work. This increase can vary drastically depending on your location, so it’s important to know what your locality pay adjustment will be in order to properly plan for the future.

What is Locality Pay?

Locality pay adjusts the base rate of pay for the cost of living in a geographic area. If you live in an area with a high cost of living, like a major city, your salary will be increased by a percentage set by the Bureau of Labor Statistics and authorized by the President. This increase will help cover the cost of living in your specific area. This makes it easier for federal employees to be assigned and relocated without much push back. Additionally, locality pay allows the government to remain competitive with the private sector, as federal salaries are often lower than their private sector counterparts.

Locality pay is adjusted based on your location of work, not your location of residence. You may consider living in a different area and commuting to your job to try to cut costs, but you must factor in the cost of your commute.

Who is Eligible for Locality Pay?

All GS federal employees and LEOs are eligible for locality pay based on where the live in the United States. There are currently 53 locality pay areas in the Unites States with most of the higher percentage areas being on the east and west coast. You can look at this map to find the percentage adjustment for the area you live in. Most of the United States falls under the “Rest of U.S” category, which is the default percentage, currently set at 16.2%.

In December 2022, four new locality pay areas were approved, and more areas were added to existing pay areas. Locality pay areas are constantly updating as the President’s Pay Agent continues to work with the Bureau of Labor Statistics.

How Does Locality Pay Work in Retirement?

The locality pay adjustment is included as part of your base pay when calculating your annuity. Your regular retirement annuity is calculated using your high 3 average and your creditable years of service. Your high 3 average, which will be calculated by the OPM, will include locality pay from the position from which you retired.

There is no adjustment made to where you live after retirement.

This means that your locality pay adjustment from the position you retired from will remain no matter where you move after retirement. You could retire from a position in a major city like San Francisco, and then move to an area with a much cheaper cost of living, and maintain that locality pay for San Francisco. This can make a huge difference to your retirement.

What About Federal Disability Retirement?

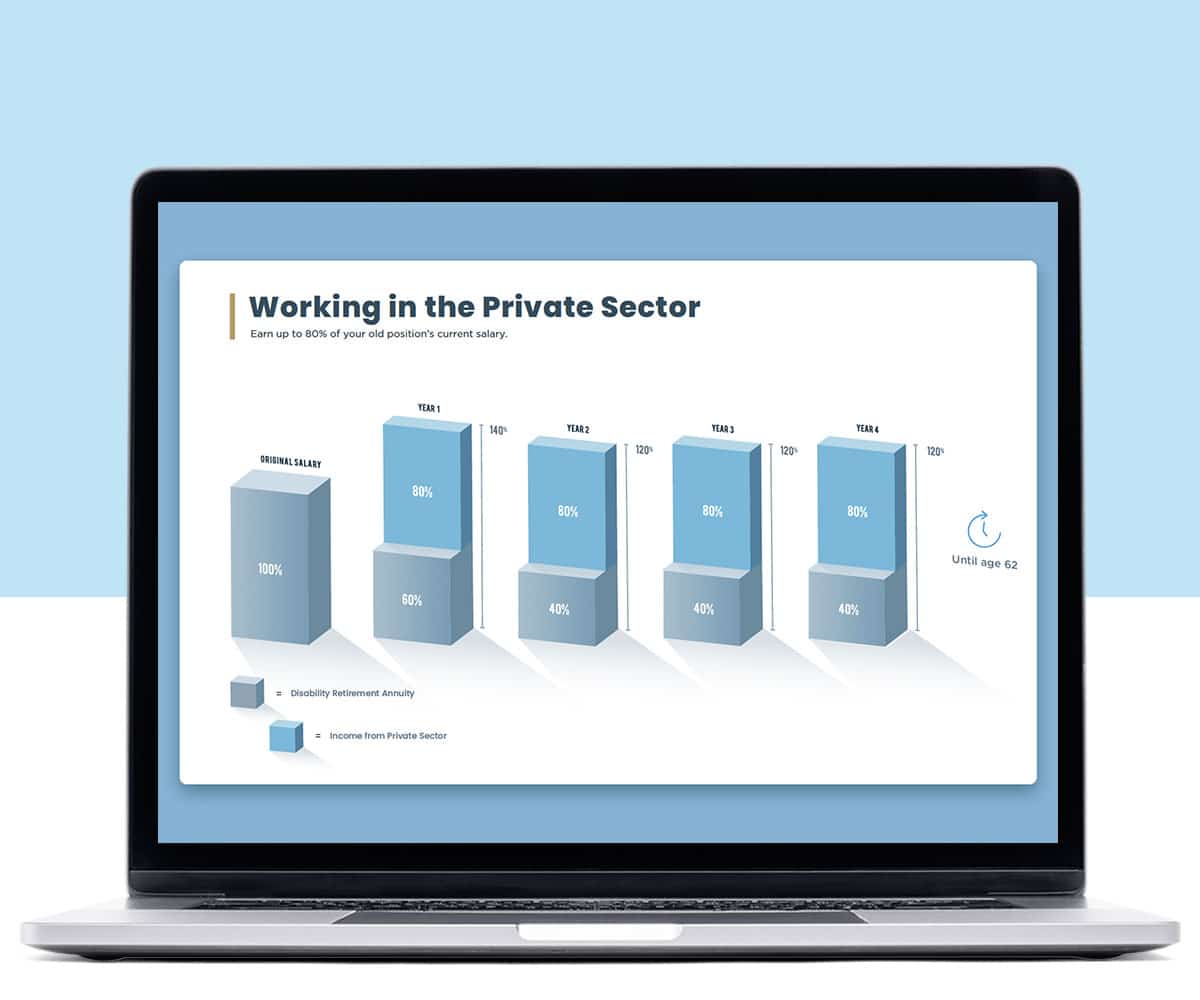

If you must take Federal Disability Retirement instead of a regular retirement, your Federal Disability Retirement annuity will be calculated with your high 3 average, and like we mentioned before, your locality adjustment from the position you retired will be included.

Additionally, on Federal Disability Retirement you will have the ability to work in the private sector and earn up to 80% of your previous position’s current salary. Your previous position will still be subject to locality pay increases. This adjustment will in turn adjust the amount of money you can earn while working in the private sector. Contact our firm today to see if you qualify for this benefit.

Locality pay can make a huge difference in your finances when looking at the future. Living in areas with a high cost of living can be stressful, but locality pay helps ease that stress so you and your family can live comfortably, even in the big city.

Hi, ready to schedule a free consultation?

Hi, ready to schedule a free consultation?