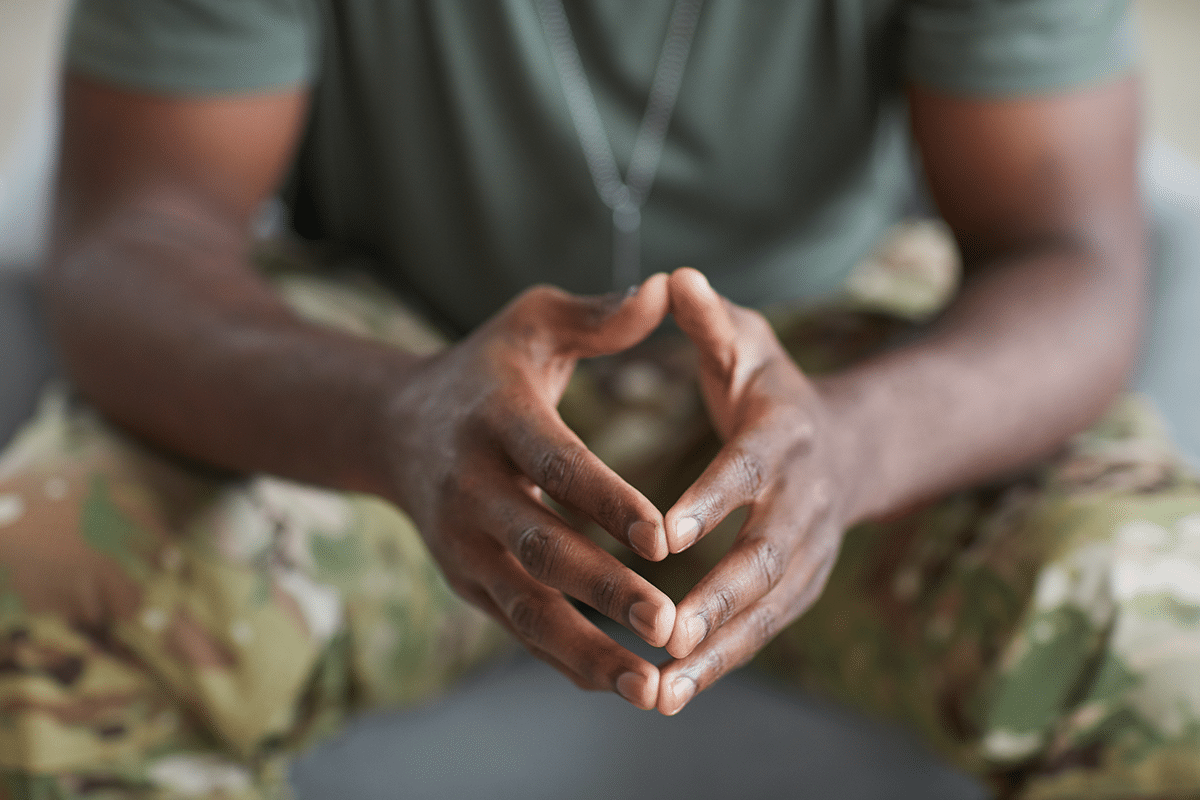

If you are a military veteran who has entered the federal workforce, you may want to buy back your military time as it could significantly benefit your future.

Buying back your military years can increase your creditable years of service, which can increase your retirement pension, providing you with more money for the rest of your life. But did you know that military buyback can work with Federal Disability Retirement to help you reach your retirement age?

This article will cover military buyback and how it can work with Federal Disability Retirement to maximize your retirement pension!

Benefits of Buying Back Your Military Years

A benefit in the Federal Employees Retirement System allows you to make a deposit, or “buy back” your active-duty military service to add on to your creditable years of service at retirement.

Buying back military service can be very advantageous to your FERS retirement. It can increase your creditable years of service, bringing you closer to retirement and increasing your retirement pension.

Any current FERS employee with prior active-duty military service and an honorable discharge is able to buy back their military time.

Each year you buy back is going to equate to 1% of your high 3 average which adds to your retirement pension for the rest of your life. That 1% will increase to 1.1% if you have more than 20 years of creditable service.

How to Buy Back Your Military Years

In order to buy your military service, you must first complete form RI 20-97, which is your Estimated Earnings During Military Service to request your earning amount. You will attach this form to your DD-214: Certificate of Release or Discharge from Active Duty. Your HR office will help you fill out and compile these forms and they will assist you in sending them to the appropriate military finance center.

Once this is complete, you will fill out the SF 3108: Application to Make Service Credit Payment and send it to your HR office who will calculate the cost of your deposit. Your deposit amount is based off your basic military pay plus interest.

You can pay your deposit amount all at once or have automatic deductions from your pay each period. But remember, you don’t have to make any deposit; it’s your choice whether or not you buy back your military time as it affects your military retired pay.

If you are receiving military retired pay, it does not impact your Federal Disability Retirement, but you will not be able to buy back your military years if you are receiving military retired pay.

Federal Disability Retirement as a Military Veteran

Federal Disability Retirement is an option available to disabled federal employees who are unable to perform all the essential functions of their job.

If you are thinking about applying for Federal Disability Retirement as a Military Veteran, you will need to buy back your military time in full prior to your separation in order for those years to count.

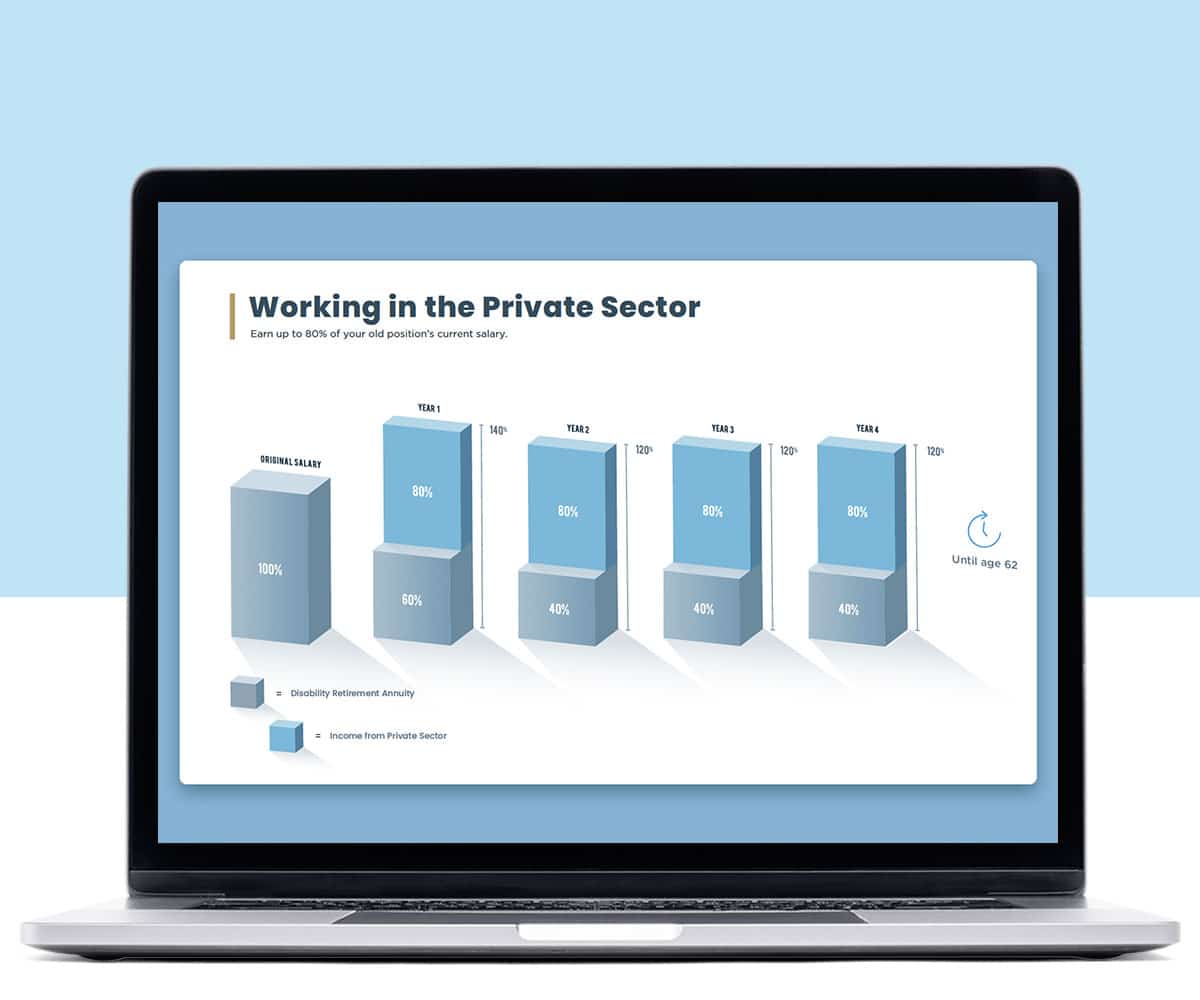

You will continue to gain creditable years of service on Federal Disability Retirement, and if you buy back your military time, those additional years will add even more to your retirement pension at 62.

The combination of military buyback and Federal Disability Retirement can help you reach your retirement age and maximize your retirement pension.

If you are a military veteran and are interested in applying for Federal Disability Retirement, schedule a FREE consultation with our firm today!

We have over 7,000 happy clients and we want you to get the most out of your federal benefits.

Hi, ready to schedule a free consultation?

Hi, ready to schedule a free consultation?